About the Cyprus Confidential investigation

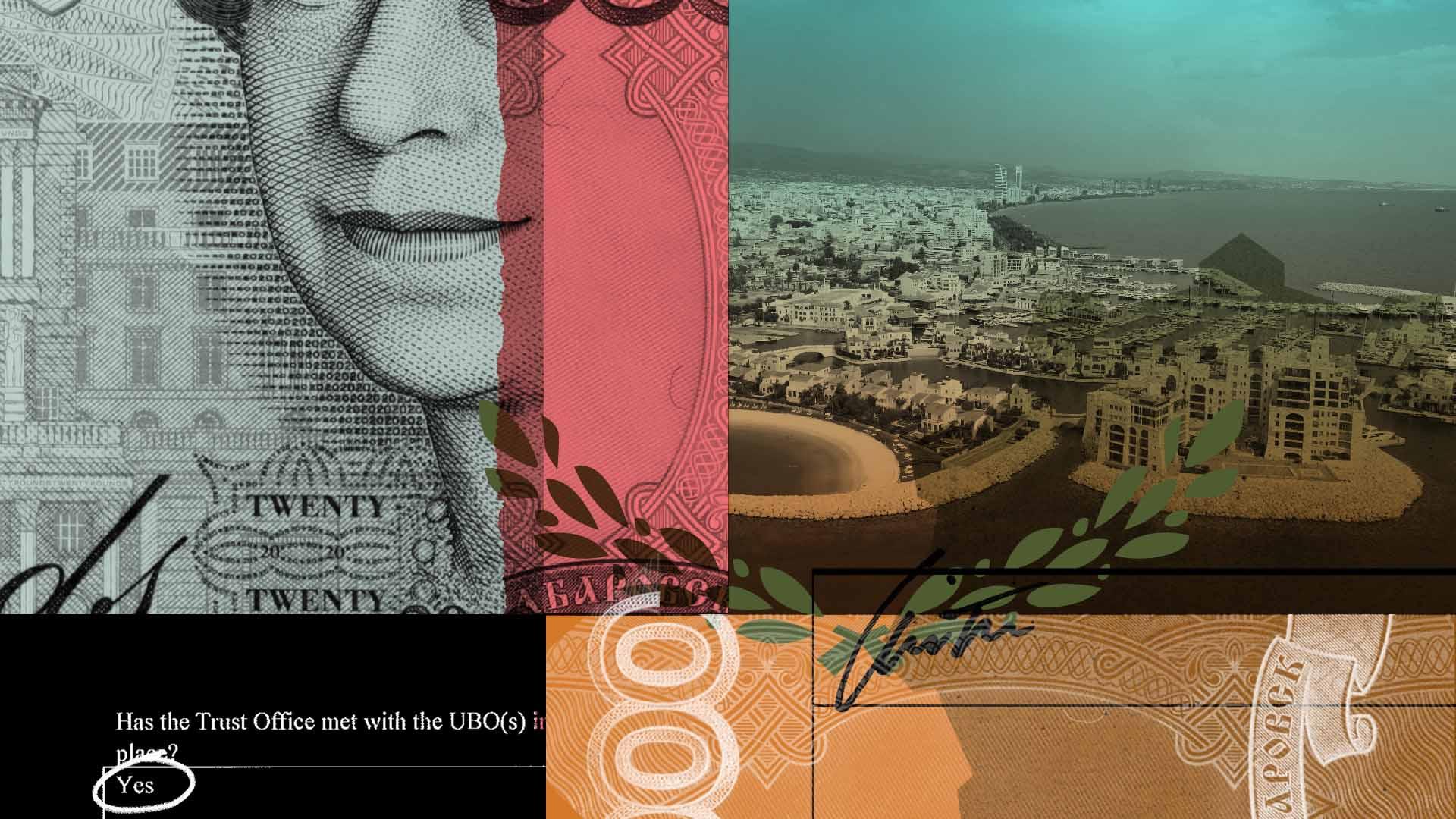

Cyprus Confidential reveals how Cypriot financial enablers scrambled to help Russian oligarchs and Putin allies shield their assets and avoid Western sanctions.

It spills the secrets of a European financial hub’s clandestine role in protecting and moving oligarchs’ assets around the world even as Russia launched its attack on Ukraine.

The investigation was led by the International Consortium of Investigative Journalists, a nonprofit newsroom based in Washington, D.C., and global network of journalists, and Munich-based Paper Trail Media.

The reporting is based on more than 3.6 million leaked files from six Cyprus-based financial services providers and a Latvian firm that sells Cypriot corporate registry documents through a website called i-Cyprus.

Clients of the financial services firms include former Chelsea Football Club owner Roman Abramovich; a Russian military contractor; and Alexander Abramov and Alexander Frolov, the oligarchs behind Evraz, the Russian steelmaker producing most of the rails for trains delivering Russia’s war materiel.

Our reporting shows how Abramovich made a covert transfer of stakes in an advertising company to Sergey Roldugin, a classical cellist and now-sanctioned friend of the Russian president.

Dubbed “Putin’s wallet,” Roldugin has previously been identified by ICIJ and its media partners as part of a clandestine network operated by Putin associates that shuffled at least $2 billion through banks and offshore companies.

Cyprus Confidential exposes how the Cyprus arm of global accounting giant PwC helped Alexey Mordashov, one of Russia’s richest industrialists, transfer a $1.4 billion investment to his life partner in a bid to elude European Union sanctions.

The investigation uncovers hidden payments by middlemen close to Mordashov to a famous German journalist to write a book about Putin’s power — a deal that highlights the sophistication of the Russian propaganda machine abroad.

It shows how Petr Aven, one of the key strategists behind Russian financial powerhouse the Alfa Group, used a Cyprus firm to shift $5 million outside of European authorities’ reach just as the EU was announcing sanctions on members of Putin’s inner circle, including him.

Reporting based on the financial documents also provides a glimpse into oligarchs’ lavish lifestyles — their private concerts featuring Amy Winehouse, Red Hot Chili Peppers and other famous rock stars; their superyachts; and their priceless art collections.

ICIJ’s analysis of the leaked records found nearly 800 companies and trusts registered in places that allow the rich to hide assets that were owned or controlled by Russians who later came under sanctions, including some who were sanctioned as early as 2014. Those include more than 650 Cyprus companies and trusts.

Our discovery of the sudden wartime shifting of many hundreds of millions of dollars in assets demolishes the notion that financial sanctions have halted Russian dark money flows.

It raises grave concerns about the active role played by Kremlin-friendly Cyprus firms in aiding Russians to evade international accountability. And it shows how the same murky operations favored by oligarchs are used by fraudsters, football financiers, money launderers, cyber spies and others.

PwC and clients who drew sanctions

The investigation grew over eight months to include 272 journalists in 54 countries and one territory from 69 media partners, including ICIJ, who pored over complex transactions and voluminous sanctions lists.

Distributed Denial of Secrets, a nonprofit devoted to publishing and archiving of leaks, Paper Trail Media obtained the Cyprus Confidential documents in seven separate leaks.

Together, reporters uncovered how PwC’s Cyprus arm partnered with small firms specializing in creating shell companies and providing frontman directors to dozens of Russians with ties to the Kremlin. An ICIJ review of the records shows that before Russia’s February 2022 invasion of Ukraine, PwC Cyprus’ client roster already included 12 Russians who were under sanctions around the world due to their involvement in their government’s illegal 2014 annexation of Ukraine’s Crimean Peninsula and military aggression in the Donbas region of eastern Ukraine.

After the 2022 invasion, an additional 39 of PwC Cyprus’ Russian clients were hit with sanctions by the EU, U.K., United States or Ukraine because of their close ties to Putin or their prominent roles in economic sectors critical to the war in Ukraine.

Previously, ICIJ has revealed how PwC helped hundreds of multinational companies spirit profits to tiny Luxembourg to reduce their tax liabilities. Later, in its Luanda Leaks project, ICIJ showed how the firm advised an African autocrat’s daughter, Isabel dos Santos, as two decades of corrupt deals made her a billionaire.

In June, the European Union, in a report drawing from ICIJ’s Pandora Papers, called for greater scrutiny of PwC and other global accountancy firms for their assistance to Russian oligarchs. The Cyprus Confidential investigation represents another embarrassment for the scandal-plagued PwC and raises questions about the EU’s monitoring of it.

More findings, more cleanup

Reporters pooled their research as they mined the files, questioned dozens of subjects, conferred with experts and traveled to Cyprus and beyond to uncover nests of trusts and shell companies used to shelter and enrich members of Putin’s inner circle, and others.

ICIJ project partners included Arab Reporters for Investigative Journalism, the Belarusian Investigative Center, The Bureau of Investigative Journalism, CBC, Der Spiegel, the Guardian, Le Monde, OCCRP, Politiken, Syrian Investigative Reporting for Accountability Journalism, Ukraine’s Slidstvo and The Washington Post.

Beyond Russia, Cyprus Confidential reporting shows how PwC administered shell companies linked to a Curacao-based insurer and pension fund allegedly looted hundreds of millions of dollars.

PwC told ICIJ that its Cyprus arm, the biggest accounting firm on the eastern Mediterranean island, had culled its client list after the Russian invasion of Ukraine.

The firm said it had terminated “approximately 150 client groups,” 60 as a result of its Russia-related sanctions policy and a further 90 after a wider “de-risking review.”

“All PwC firms, including PwC Cyprus, take the application of sanctions against clients and sanctions prohibiting various professional services extremely seriously,” it said in a statement.

Cyprus Confidential reporting brings to light several efforts by Cyprus middlemen at the height of the Syrian civil war to assist Damascus in placing orders for American oil and gas drilling equipment even though Western sanctions were in place.

It reveals how a Polish skincare entrepreneur and ex-wife of an Israeli military intelligence commander attempted to conceal her involvement in an intricate network of cyber surveillance firms.

And it shows how Ukrainian oligarch Rinat Akhmetov quietly agreed to buy a London penthouse, parking spaces and other amenities for about $122 million through a British Virgin Islands-based shell company. In response to questions, lawyers for Akhmetov said he was Ukraine’s largest individual taxpayer.

At a recent press conference, a Cyprus government spokesman announced stepped-up efforts to coordinate sanctions enforcement internationally and said these efforts demonstrate “the government’s stated intention to show zero tolerance on matters concerning sanctions evasion and law violation, and by extension, to safeguard the country’s name as a reliable financial center, which is considered to be of key importance.”